- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

US-China trade war re-escalates to highest level

Howdy market watchers!

Well, it’s another circle around the sun for yours truly. I’m older and greyer, but not sure how much wiser. I’m definitely wiser from plenty of trying new things and unexpected experiences, for what that’s worth.

The world around us is fast changing and while simpler in some ways, it is more complicated in other ways. Information is constant, instant and global. The ability of influential actors to share actions and reactions has the markets on a constant edge.

After a wild week across markets, President Trump’s comments via social media on Friday in reaction to China trade actions on Thursday lent to escalating tensions in an already tenuous relationship ahead of a scheduled summit at the APEC meetings at the end of October in South Korea.

While no official actions were taken while the market was open, the tone of Trump’s commentary suggested a “massive increase” in tariffs on China imports to the US and that there was no reason to meet coming up. After the main session close, Trump did announce 100 percent tariffs would be put back in to place on China imports to the US.

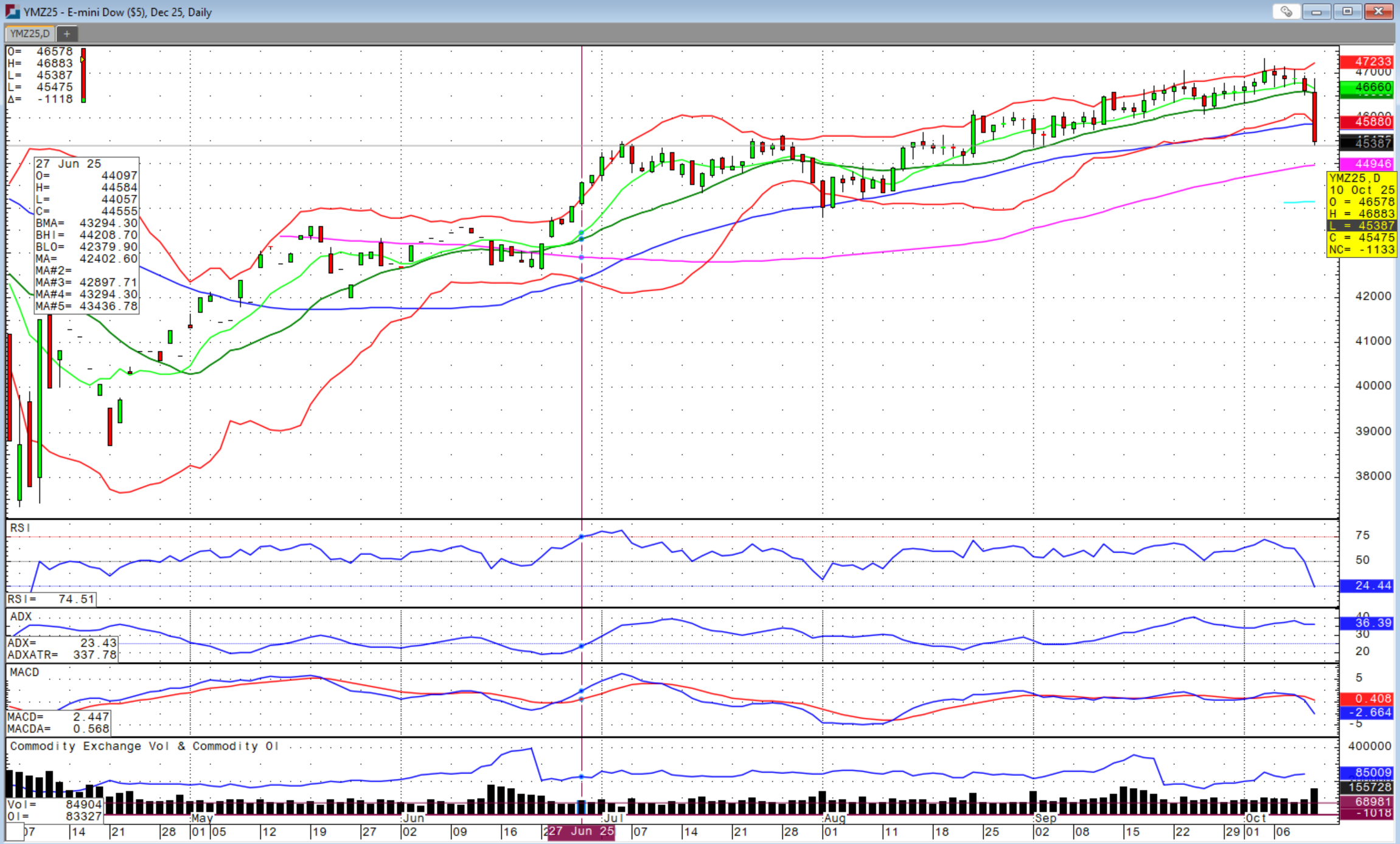

All markets took the initial threat hard with soybeans and equities leading the selloff.

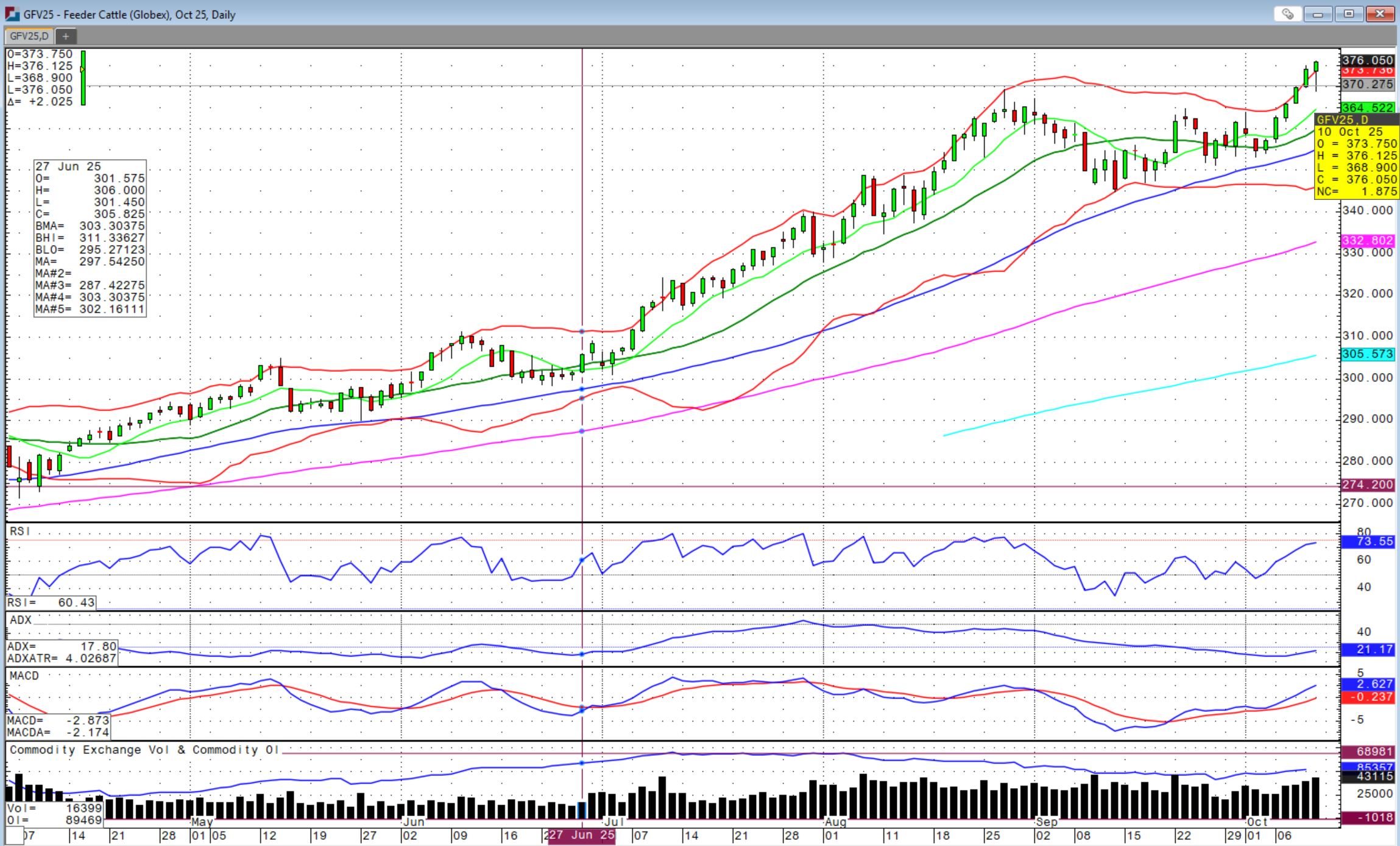

The cattle markets soon followed as did wheat and corn although much of the grain weakness was in the overnight. However, in true cattle market insanity that we’ve been living, both feeder and deferred live cattle contracts put in an outside reversal higher session, lower low and higher high, on Friday. In fact, feeder contracts posted another new, all-time record high that followed the two prior sessions of new highs. Unbelievable! Fed cattle cash trade started picking up on Friday as well with highs at $235 in Texas and Kansas. Feeder and live cattle contracts closed at or near session highs with more up expected next week.

The week started with another case of the New World Screwworm reported in Mexico, 170 miles from the US border, the second closest reported case with the September 21st case only 70 miles from the border. Preliminary talks with Brazil early in the week that failed also contributed to the market strength as tariffs remain in place on beef imports that will relieve some market tightness if ever dropped.

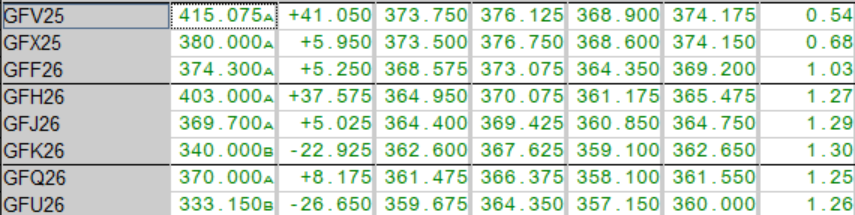

After the market closed on Friday, there was one sell order on October feeders at $415.075 that remained working and appearing on the quote board. That doesn’t necessarily mean anything, but breaks the ice that we could be headed for a “4 handle”.

The boxed beef cutout that bottomed this week is basically at $4.00 per pound, meaning that cash wheat price per bushel is equal to one pound of beef. Just a reminder of the enormous contrast between the grain and beef markets at present. Nothing short of extraordinary.

Meanwhile, the US government remains shutdown with Democrats and Republicans at a deadlock after multiple failed votes. Federal government jobs began to be cut on Friday as well as Democrat-backed government programs to further up the political pressure. The big disappointment to the US agricultural community this week was the lack of support announced on Tuesday, as was promised, that was blamed on the fact that the government was still shut down.

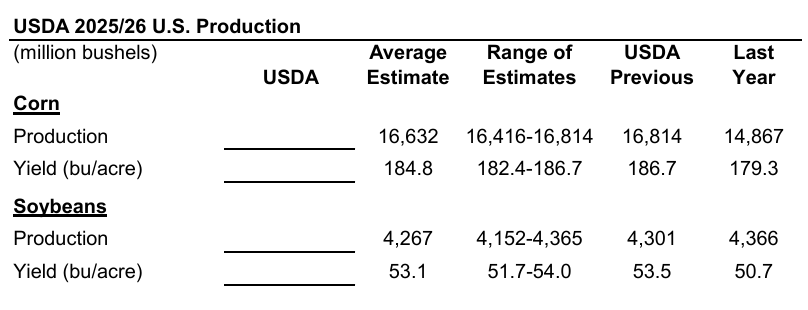

The USDA’s WASDE and Crop Production reports set for an October 9th release also did not happen that would have likely shown declining yields and been somewhat supportive for markets. The absence of could very well lead to softer markets.

In Congress, it is fair to say that both sides are dug in behind their positions on the issue with continued chess moves being played to force a hand. Key deadlines are right ahead for federal employees to be paid and this includes the US military.

The precious metals markets have benefited from the deadlock with gold and silver hitting new, all-time highs yet again. The US dollar also rebounded, which contributed to the headwind for the grains.

Energy markets were under huge pressure with crude oil down nearly 4.5 percent, below the $60 mark. Fuel contracts were also down 3.5 percent while natural gas was down nearly 2.0 percent. Such relief in the energy markets is welcome for agriculture users with how much the grain markets have declined.

Wheat markets posted new lows overnight on Friday as Russia again increased production estimates. Snowfall and freezing temperatures in northern Russia as well as fewer acres planted in the year ahead added some support to wheat markets earlier in the week, but wasn’t enough to outweigh bearish pressure from increased global crops, a stronger US dollar and overall negative market sentiment for demand. Stress across the economy continues to become more apparent.

However, the explosion of AI stocks continues to create headline optimism. The “buy the dip” mentality persists as more the norm than the exception across the major stock indices as well as the cattle markets. Stock indices did, however, finish the day near session lows and basically gave back almost all of the September gains. October is often a volatile month as the fourth quarter kicks off heading into the year-end performance goals.

The lack of economic data from the government shutdown only compounds this situation as does the increasing divergence between the Federal Reserve’s two mandates, namely price stability and employment, that makes the next interest rate move less obvious.

Regardless of the US government being open by then, the FOMC will announce its interest rate decision on October 29th. It will be an interesting next two weeks leading up to the end of the month. At least we have rain chances returning along with cooler temperatures to lower the thermometer. The Trump Agreement ceasefire between Israel and Hamas has been a major headline this week on the international conflict front. While such deal is good on the humanitarian front, it has little impact on the markets. The Russia-Ukraine conflict continues to wage on with stepped up attacks this week. However, that situation does have immediate market impacts and ripple effects for grains as well as energy prices globally.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.